MetaDAO, Hurupay için Yenilikçi Sınırsız İndirim Kampanyası Başlattı

In a notable evolution within the decentralized finance (DeFi) landscape, MetaDAO has announced the public sale for Hurupay, a banking platform integrating cryptocurrency features, set to begin on February 3, 2026, at 18:30 UTC. This sale marks a significant departure from previous MetaDAO initial coin offerings (ICOs), addressing longstanding issues with oversubscription and market manipulation.

Background on MetaDAO and Hurupay

MetaDAO, a governance protocol leveraging futarchy (decision-making via prediction markets), has become a prominent launchpad for crypto projects on Solana. It emphasizes fair, public sales with high token floats and no private allocations to prevent unfair advantages. Hurupay, backed by investors from Microsoft and Bankless, offers users US and EUR bank accounts, virtual USD cards, high-interest savings, and stock purchasing capabilities, all powered by stablecoins for global payroll and payments. The project already boasts a live product with real users and revenue, distinguishing it from earlier-stage ventures.

The sale allocates 10 million HURU tokens (39.02% of total supply) to the ICO pool, with a minimum raise of $3 million. Unlike past sales, this one is uncapped, meaning all committed funds will flow directly into Hurupay's treasury without pro-rata refunds.

Key Differences from Previous MetaDAO Sales

Traditional MetaDAO ICOs operated on a capped, pro-rata model, where oversubscription led to refunds of excess contributions. This structure incentivized "whale games," where large investors oversized their commitments to secure bigger allocations, artificially inflating totals, often by 10x or more, as seen in launches like MegaETH (27.8x oversubscribed, raising $1.39 billion) and Umbra (200x). Such mechanics favored big players and encouraged last-minute surges, enabling speculation on platforms like Polymarket.

In contrast, Hurupay's sale eliminates refunds entirely. Funds exceeding the $3 million minimum are allocated to a "bid wall",an on-chain program that buys back tokens at net asset value (NAV), burning them to reduce supply. Any unspent bid wall funds after three months roll into the treasury. Additionally, 20% of raised funds go to USDC liquidity.

For illustration: If $50 million is raised, $10 million (20%) supports liquidity, $3 million funds operations, and the remaining $37 million bolsters the bid wall for NAV buybacks. This turns excess demand into downside protection rather than operational fuel, reducing rug-pull risks and aligning incentives for long-term growth. Team spending is capped at $250,000 monthly but varies based on needs, with vesting tied to time (not KPIs, unlike some prior projects).

Impact on Market Dynamics and Speculation

This mechanic discourages oversized contributions, as excess funds don't yield proportional tokens but instead enhance token safety. Community reactions highlight reduced "farming" opportunities, where whales fake volume for refunds—potentially leading to lower overall commitments compared to hyped predecessors.

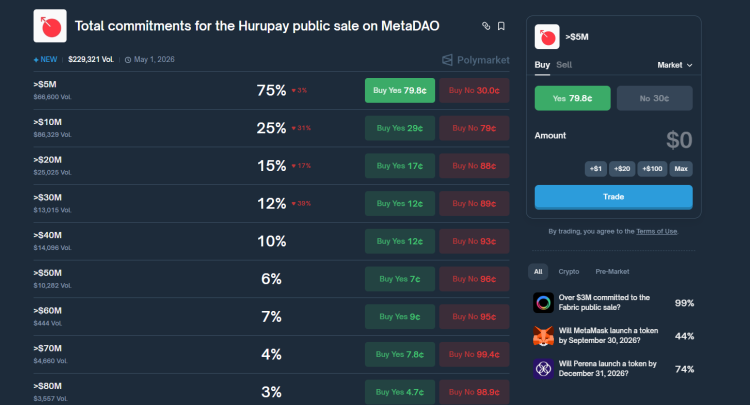

On Polymarket, the "Total Commitments for the Hurupay Public Sale on MetaDAO" market reflects this shift. As of January 28, 2026, odds for over $5 million stand at 79% (Yes at 82.7c), with $200,394 in volume, while >$10 million is at lower probabilities. Traders note the quick stabilization of prices, as large bets become less advantageous, contrasting with volatile surges in prior sales.

Broader Implications for Crypto Fundraising

By making sales uncapped and excess-focused on protection, MetaDAO aims to better reflect true demand and mitigate gaming. Critics, however, raise concerns about potential scams or high spending, though proponents argue the transparent, MetaDAO-governed treasury provides safeguards. This could set a precedent for more equitable ICOs, especially as the crypto industry navigates regulatory scrutiny and market maturity.

This article is not financial advice. Always do your own research and weigh all the pros and cons before entering a token sale.

3 ücretsiz kasa ve tüm nakit para yatırma işlemlerine %5 bonus eklenir.

5 Ücretsiz Kılıf, Günlük Ücretsiz ve Bonus

Para yatırma ve çekme işlemlerinde %0 ücret.

11 Para Yatırma Bonusu + FreeSpin

EKSTRA %10 PARA YATIRMA BONUSU + ÜCRETSIZ 2 ÇARK DÖNDÜRME

Ücretsiz Kasa ve %100 Hoş Geldin Bonusu

Yorum